The Open Banking initiative is a revolution in financial services. It aims to enable consumers to share their data with banks and other financial providers, who can then use this data to provide innovative new services aimed at improving the customer experience. The technology underlying Open Banking has been in development for several years now and is finally starting to be rolled out by banks across Europe, with UK banks leading the way. Here we explain how Open Banking works and why it matters for both consumers and businesses alike.

What is Open Banking?

Open banking is a new way of doing business, which allows consumers to share their financial data with third parties. This is not a new concept; it has been around for a while and has been implemented in other countries (such as Australia, Japan, and Sweden). However, it’s only recently that the UK government has decided to introduce this initiative into its economy and now other countries are following suit.

What does this mean for consumers? It means that we’ll have more choices when it comes to our money: whether you want someone else managing your finances or just monitoring them from afar, there will be an option out there for everyone!

How will this affect banks? Well…we’re not entirely sure yet…but if we had to guess based on experience: not well! Banks are traditionally protective over their customers’ data because they use it themselves in order to make money via lending products; however, now these same customers have access as well through apps like Monzo (a British digital bank) or Starling Bank which allows users to have access to their account via an app. As a result, banks are losing out on revenue which is why they’re not too happy about this new initiative. But, as consumers, we’re very excited that the UK is not the only country that has plans for open banking. Australia, France, and Spain are all following suit and will be implementing similar changes in their banking systems soon!

The Consumer-Centric Revolution

The consumer-centric revolution is a shift in the way people interact with their banks. It’s about changing the way people think about their money, empowering consumers to take control of their financial lives, and making it easier for them to do so.

Cyprus company formation plays a vital role in this financial evolution. Cyprus, with its strategic location, robust legal framework, and business-friendly environment, has become a preferred destination for businesses looking to establish a presence in the European Union.

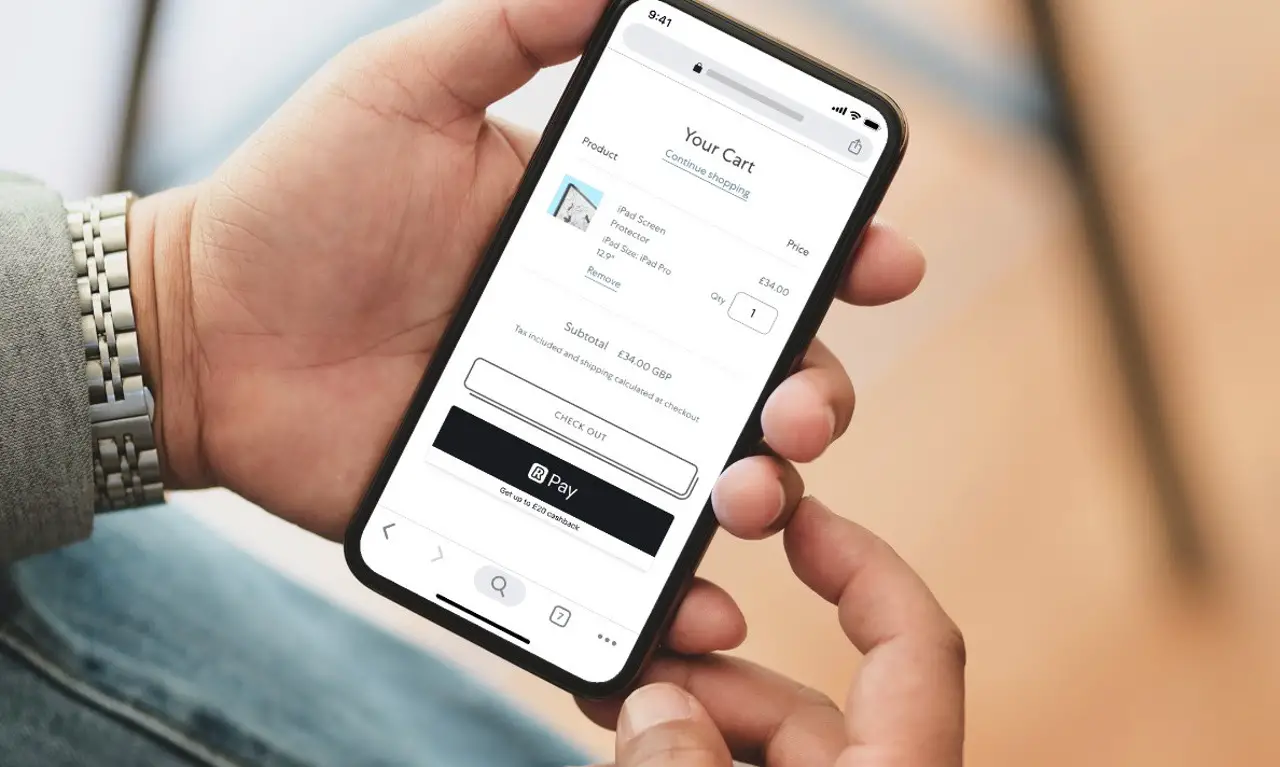

Open banking is a new way for consumers to interact with their banks through an API (application programming interface) that allows third-party providers access to data from within banks’ systems. This enables developers and fintechs (financial technology companies) such as Moneybox or Nutmeg to build innovative products that use this data in new ways, such as helping users track spending habits or saving automatically based on goals set by users themselves rather than by algorithms alone. Open banking is about changing the way people think about their money, and empowering consumers to take control of their financial lives. It’s part of the broader transformation in financial services that includes not only open banking but also advancements like blockchain technology and digital currencies, all aimed at providing consumers with more control and transparency over their finances.

Innovative Services and Fintech Collaboration

Open banking is a concept that has been around for some time, but it is only recently that we have seen the technology necessary to bring this idea to life. The combination of open banking and fintech could create an entirely new landscape for consumers and financial services providers alike.

The benefits of collaboration between fintech and open banking include:

- Increased access to innovative services

- Greater choice for consumers

- Increased competition among service providers

As we move forward, the technology behind open banking is poised to improve. This will allow banks to provide even more services, which could further increase competition.

Financial Inclusion

Open Banking is a new concept that will change the way we interact with our bank accounts. Consumers will have more choice in how they interact with their finances, which means they can choose which services they want to use and who provides them.

The government is trying to help consumers have more control over their banks so that people who are less well-off or disadvantaged can access good financial products without being taken advantage of by providers who charge high fees for poor-value products.

Consumers will be able to choose which services they want to use and who provides them, as well as switching between providers easily if one does not meet their needs or standards anymore (or if another provider offers something better).

Open Banking is a powerful tool for consumers and businesses. It will help people manage their finances more easily by giving them access to information about their spending habits, investments and loans. Open Banking will also make it easier for fintech companies like ours to offer new financial services that can help people save money on things like insurance premiums or loan payments each month.